First-Generation Homebuyer Loan Program

As of December 19, 2024, these one-time funds have been exhausted and the program is closed. We are unable to accept any more First-Generation Homebuyer Loan Commitments. If you were not able to access our First-Generation Homebuyer Loan, there may be other downpayment assistance programs available. To explore additional DPA resources that may be available, check out our other Homeownership Programs as well as the Minnesota Homeownership Center's Down Payment Assistance Search Tool. There are several first-generation homebuyer programs still available, such as the First-Generation Homebuyers Community Down Payment Assistance Fund.

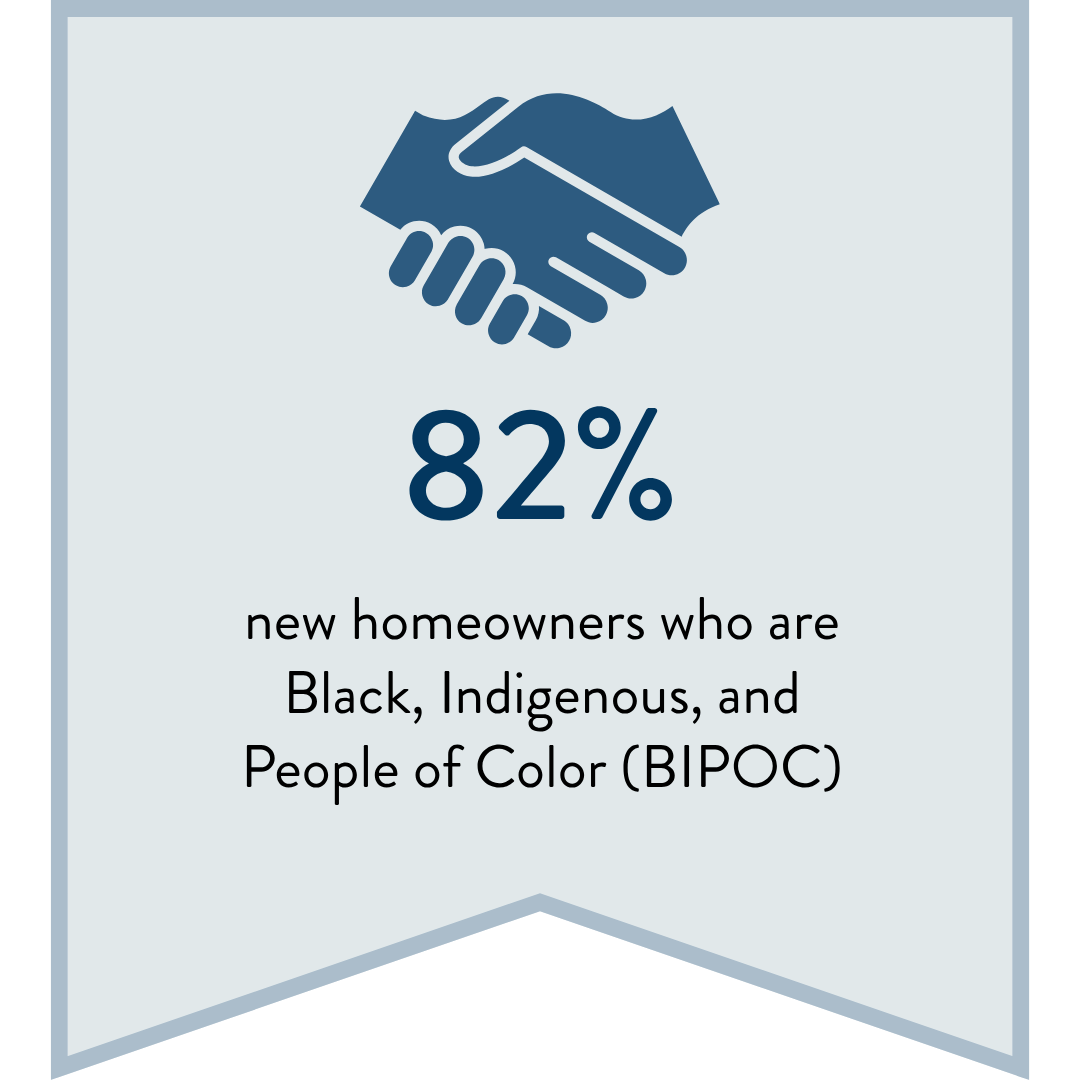

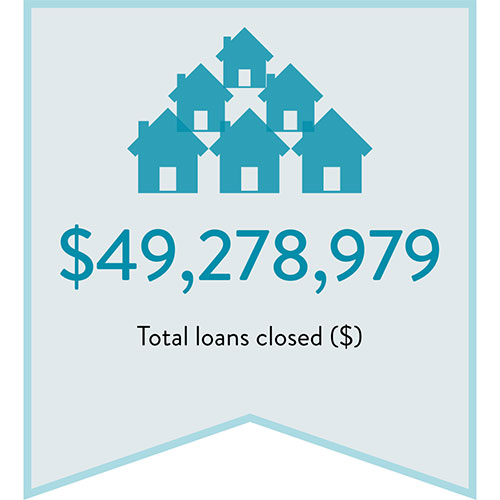

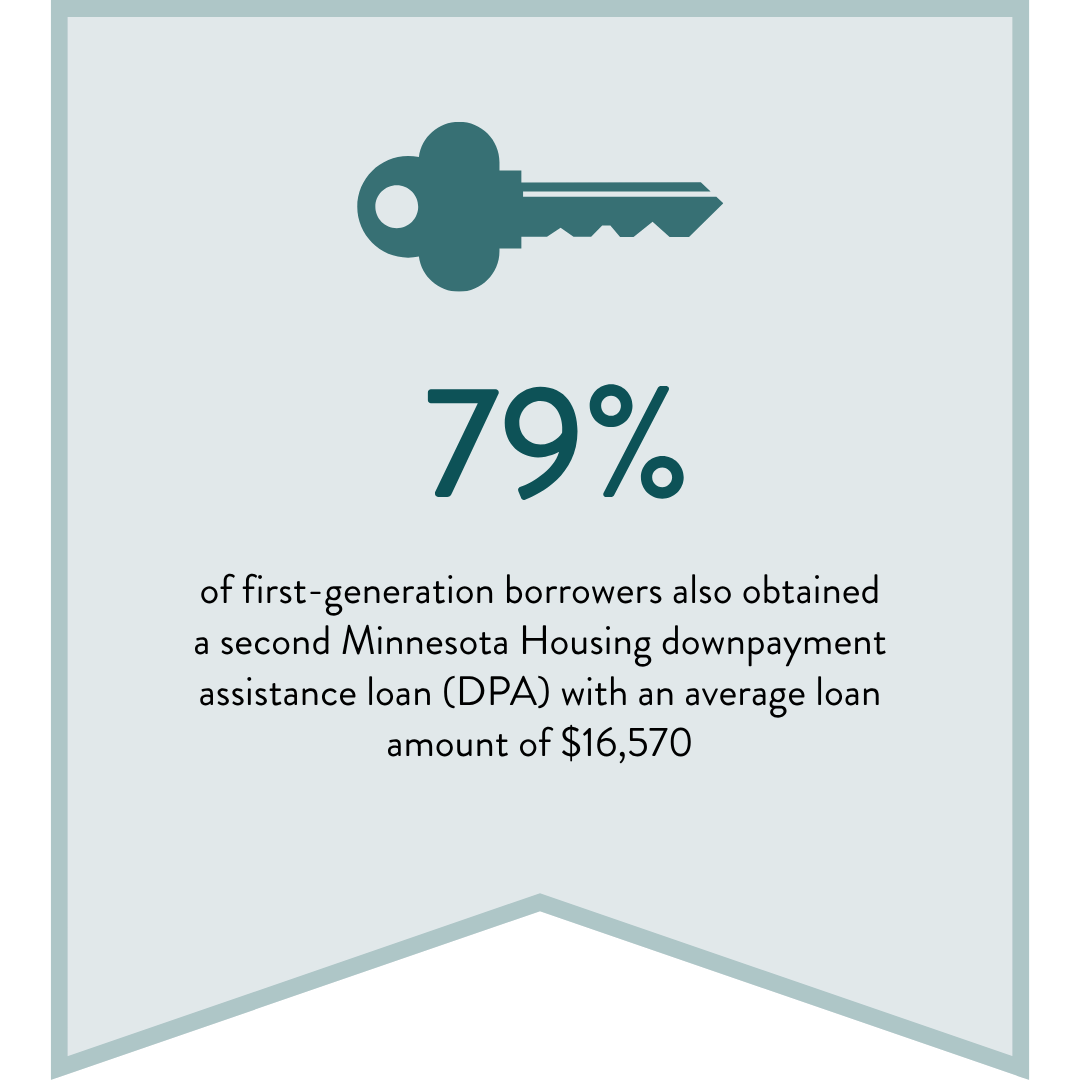

Program Results

Here is a snapshot of the initial program results. Please see the First-Generation Homebuyer Loan Program Recap for expanded data.

In connection with Single Family Division loan programs, Minnesota Housing does not make or arrange loans. It is neither an originator nor creditor and is not affiliated with any Lender. The terms of any mortgage finance transactions conducted in connection with these programs, including important information such as loan fees, the annual percentage rate (APR), repayment conditions, disclosures, and any other materials which are required to be provided to the consumer are the responsibility of the Lender.